Companies or individuals in the United States who make a commercial sale for export need to be aware that although the National Export Initiative has been working to streamline and simplify the process, there are still obligations they must meet. In the eyes of the government, the seller / exporter is known as the U.S. Principal Party of Interest, or USPPI.

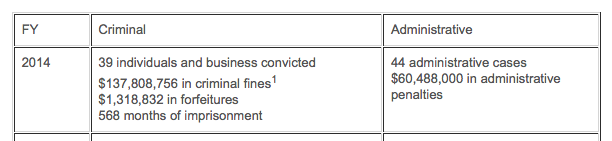

“But I’m selling ex-works,” sellers say. “All of the obligations from my doorstep are for the account of the buyer.” Not true. The U.S. government wants to know what is being shipped, who it is being shipped to and in many cases, it might also require a license to ship it to them in the first place.  The Justice Department settles with many companies who violate the export regulations every year. In fact, according to the Bureau of Industry and Security, in FY 2014, 39 individuals and businesses were convicted of export violations totalling nearly $138 million in criminal fines, $1.3 million in forfeitures and an aggregate 568 months of imprisonment.

The Justice Department settles with many companies who violate the export regulations every year. In fact, according to the Bureau of Industry and Security, in FY 2014, 39 individuals and businesses were convicted of export violations totalling nearly $138 million in criminal fines, $1.3 million in forfeitures and an aggregate 568 months of imprisonment.

So what is an exporter supposed to do?

Customs and Border Protection (CBP) defines the USPPI as:

A U.S. Principal Party in Interest (USPPI) is the person or legal entity in the United States that receives the primary benefit, monetary or otherwise, from the export transaction. Generally, that person or entity is the U.S. seller, manufacturer, or order party, or the foreign entity while in the United States when purchasing or obtaining the goods for export.

Depending upon the Incoterms, the USPPI may not be required to submit the Electronic Export Information (EEI), but they are responsible for providing the information necessary for the purchaser’s authorized representative under a routed export transaction. According to the Foreign Trade Regulations, the requirements of a USPPI are:

- Prepare and file Electronic Export Information (EEI) itself or;

- Authorize an agent to prepare and file the EEI on its behalf.

- Provide the authorized agent with accurate and timely export information.

- Provide the authorized agent with a power of attorney or written authorization to file the EEI

- Make a License Determination.

- Retain documentation for five years.

We cannot stress enough that the penalties for non-compliance with these regulations are severe. USPPI’s should also ensure that the recipients of their goods are authorized to receive them and are listed on any of the denied parties lists that are maintained by various US federal agencies.

Everglory can assist USPPI’s in complying with the regulations.

Whether Boston, Chicago or Los Angeles, Everglory employs experienced export staff who know the regulations and can assist you in completing and filing this information. There are limits to what we can legally provide and we recommend that license applications and determinations be completed with the guidance and assistance of counsel or directly with representatives of State, Commerce and the Census Department to get binding determinations on what needs to be done.

For more information about the obligations of a USPPI and how Everglory can assist in a routed or non-routed export transaction, contact us today.